In 2014, the average federal income tax rate paid by a household in the bottom half of the income distribution in the United States was

A. 3.45%

B. 4.41%

C. 20.0%

D. 23.45%

Answer: A

You might also like to view...

The Bank of Japan is Japan's central bank. As part of its duties, the Bank of Japan would

A) provide banking services to Japan's citizens and firms. B) provide banking services to foreigners. C) control the quantity of money in circulation in Japan. D) change tax rates.

Suppose that consumer income decreases and that hamburger is an inferior good. Which of the following will occur in the market for hamburger?

A) Market clearing price will rise, and equilibrium quantity will rise. B) Market clearing price will fall, and equilibrium quantity will fall. C) Market clearing price will rise, and equilibrium quantity will fall. D) Market clearing price will fall, and equilibrium quantity will rise.

In the above figure, the monopsonist will employ

A) L2 at a wage of W2. B) L2 at a wage of W3. C) L1 at a wage of W1. D) L1 at a wage of W3.

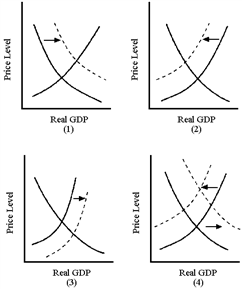

Figure 10-6

In Figure 10-6, which graph best illustrates the effect of the beginning of the Iraq war in 2003?

a.

(1)

b.

(2)

c.

(3)

d.

(4)