Each of the following would increase the demand for U.S. dollars, shifting the demand curve for dollars to the right, except:

A. an increase in real GDP abroad.

B. an increased preference for U.S.-made goods.

C. an increase in the real interest rate on U.S. assets.

D. an appreciation of foreign currencies relative to the U.S. dollar.

Answer: D

You might also like to view...

OPEC, the Organization of Petroleum Exporting Countries, was formed in Baghdad in 1960. Since its formation, this cartel has suffered from a major problem with respect to the quota (limit) of output it assigns each member nation

What is OPEC's goal and what sort of quota do you think the cartel assigns? How and why do nations cheat on their quota? What happens when a nation cheats on its quota?

Sam has no job but keeps applying to get a job with a business that is unionized. He is qualified and he finds the pay attractive, but the firm is not hiring. Sam is

a. structurally unemployed. Structural unemployment exists even in the long run. b. structurally unemployed. Structural unemployment does not exist in the long run. c. frictionally unemployed. Frictional unemployment exists even in the long run. d. frictionally unemployed. Frictional unemployment does not exist in the long run.

Suppose an economist is analyzing the impact of a budget deficit used to finance a significant infrastructure project that will pay significant dividends in the coming years. That economist will focus on

A. strictly the inflation-adjusted amount borrowed. B. strictly the amount borrowed. C. both the ratio of the deficit to GDP and whether what is purchased with the borrowed money will produce enough gains to be worth that borrowed. D. strictly the ratio of the deficit to GDP

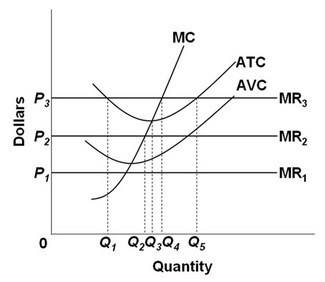

Refer to the above diagram. All data are for the short run. Which of the following statements is correct?

Refer to the above diagram. All data are for the short run. Which of the following statements is correct?

A. At price P1, the firm will close down. B. Production is profitable only when price is at P2. C. Average fixed cost is P1P3 at output Q1. D. The firm will produce an output of Q1 when price is P1.