Kohlberg’s Model of Moral Development has been criticized for ______.

A. focusing exclusively on individualistic viewpoints of moral development

B. focusing on moral development, which is not ethical development

C. the non-inclusive subject sample used in developing the model

D. the authoritative nature of the stages

C. the non-inclusive subject sample used in developing the model

You might also like to view...

The purchasing manager is evaluated by his/her supervisors based on purchasing inventory at the lowest price. Consequently, the purchasing manager knowingly orders materials only based on price. This has resulted in the purchase of inferior quality materials. This improved the purchasing manager's performance evaluation, but had a negative impact on production due to an increase in scrapped

materials. This situation is an example of a failure of: a. goal congruence b. management perquisites c. management by exception d. control theory

In the context of attitudes and organizational citizenship behaviors (OCBs), affect tends to direct OCBs toward other organizations.

Answer the following statement true (T) or false (F)

Wedney, Inc sold a meat processing machine to Yoro Chickens, taking a security interest in the machine. Yoro Chickens defaulted on the loan. Wedney repossessed the machine. Wedney would like to retain the machine to use as a model. Which of the following statements is correct?

a. Wedney must notify the debtor that it intends to retain the machine and give Yoro 20 days to object. b. By taking possession, Wedney automatically foreclosed on the collateral. Wedney has valid title and need do nothing else. c. Since the machine is equipment, Wedney cannot retain the machine. Wedney must dispose of the collateral in a commercially reasonable manner. d. Wedney can retain the machine but must pay Yoro the surplus, the difference between the fair market value of the machine and the amount of the debt.

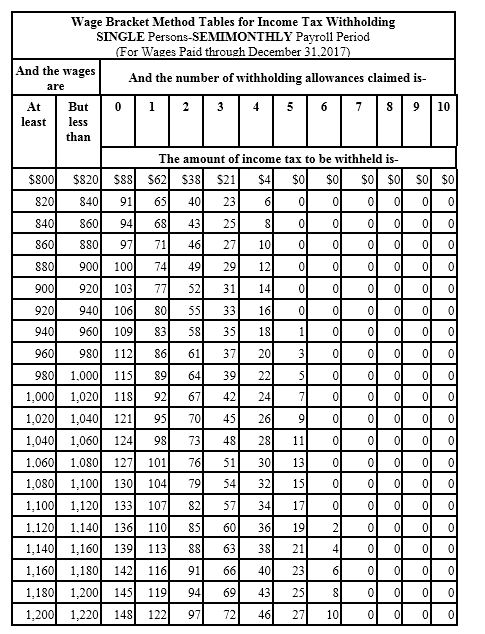

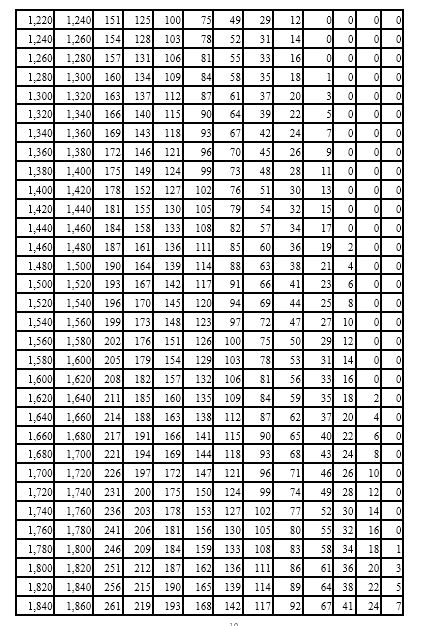

Julio is single with 1 withholding allowance. He earned $1,025.00 during the most recent semimonthly pay period. He needs to decide between contributing 3% and $30 to his 401(k) plan. If he chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table)?

A) $77.00

B) $86.00

C) $92.00

D) Both yield the same tax amount