Cushman Company had $814,000 in sales, sales discounts of $12,210, sales returns and allowances of $18,315, cost of goods sold of $386,650, and $280,015 in operating expenses. Gross profit equals:

A. $396,825.

B. $783,475.

C. $409,035.

D. $116,810.

E. $415,140.

Answer: A

You might also like to view...

In May, one of the processing departments at Messerli Corporation had beginning work in process inventory of $14,000 and ending work in process inventory of $35,000. During the month, $148,000 of costs were added to production and the cost of units transferred out from the department was $127,000. The company uses the FIFO method in its process costing system. In the department's cost reconciliation report for May, the total cost to be accounted for would be:

A. $310,000 B. $324,000 C. $162,000 D. $49,000

In making any decision that affects the size of inventory, what are the four categories of cost that must be considered?(1) ________(2) ________(3) ________(4) ________.

What will be an ideal response?

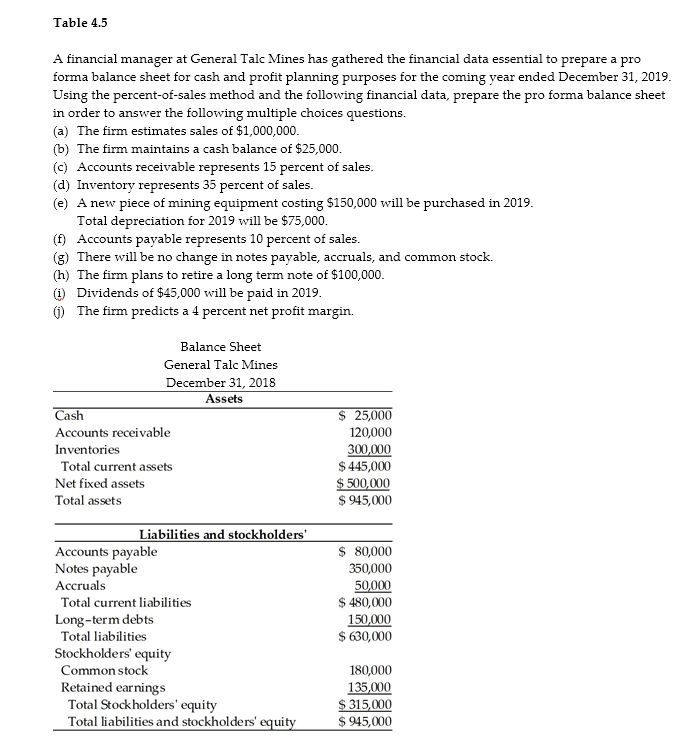

If General Talc Mines cannot raise the external financing required through traditional credit channels, the firm may ________. (See Table 4.5)

A) increase sales

B) purchase additional fixed assets to raise productivity

C) sell common stock

D) factor accounts receivable

In the context of the 5S principles, _____ refers to ensuring that each item in a workplace is in its proper place or identified as unnecessary and removed

A) sort B) sustain C) standardize D) set in order