Describe how Disney decided to deal with long lines

What will be an ideal response?

The theme park implemented virtual waiting lines in response to long waiting lines and subsequent customer dissatisfaction. Customers pick up a special pass that tells them how close to the front of the line they are without actually standing in line. This causes lines to self-regulate such that customers who are not close to the front, do not stand around taking up space and find alternative things to do. This enhances both customer satisfaction and has been shown to increase profit because customers will spend money elsewhere instead of idling in line. Disney does not charge extra for the privilege of the pass.

You might also like to view...

Relative to the current year, the sales manager's proposal will ________.

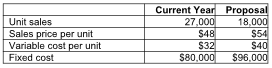

Alvarez Company is facing an $8 increase in the variable costs of producing one of its products for the upcoming year. As a result, the sales manager has made a proposal to increase the sales price of the product while increasing the advertising budget at the same time. The sales price increase will lower sales volume, but the other changes may help the company maintain its profit margin. Alvarez has provided the following information regarding the current year results and the proposal made by the sales manager:

A) decrease operating income by $324,000

B) increase contribution margin by $196,000

C) decrease the unit breakeven point

D) decrease operating income by $196,000

Andrew Fastow's role as an officer of an SPE was not a conflict of interest

Indicate whether the statement is true or false

Psychological sexual harassment occurs when sex-related behavior interferes with an employee's work performance or creates an intimidating, hostile, or offensive working environment.

Answer the following statement true (T) or false (F)

Charitable contributions made by a fiduciary

A. flows through to be deducted on the beneficiary's tax return. B. must be authorized in the trust instrument in order to be deductible. C. are limited to 50% of fiduciary income. D. are subject to the 2% floor.