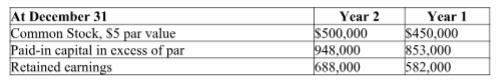

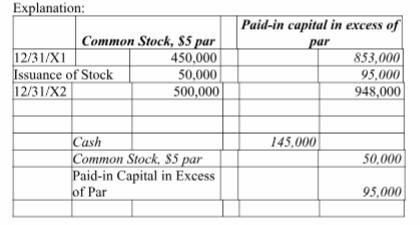

Bagwell's net income for the year ended December 31, Year 2 was $185,000. Information from Bagwell's comparative balance sheets is given below. Compute the cash received from the sale of its common stock during Year 2.

A) $185,000.

B) $106,000.

C) $95,000.

D) $50,000.

E) $145,000.

E) $145,000.

You might also like to view...

Which of the following is not a way of establishing common ground when in a conflict situation?

A. align with common enemies B. establish common expectations C. establish superordinate goals D. manage time constraints and deadlines

Use this information to answer the following question. Oct. 1 Inventory 200 units @ $12.00 6 Purchase 300 units @ $13.20 13 Purchase 100 units @ $14.40 20 Purchase 200 units @ $15.60 25 Purchase 40 units @ $16.80 Total sales 620 units A periodic inventory system is used. Using FIFO, the cost assigned to ending inventory is

A) $8,112. B) $2,664. C) $3,480. D) $8,928.

When was the Federal Sentencing Guidelines for Organizations Act passed?

a. 1957 b. 1989 c. 1991 d. 1997

The lower the reach and frequency, the higher the cost of an advertising campaign will be.

Answer the following statement true (T) or false (F)