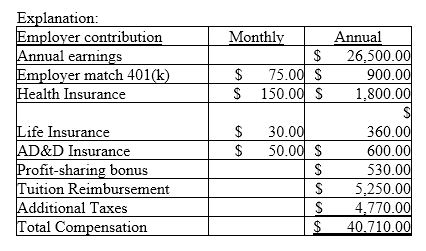

John works for Heinlein Hillclimbers in Wyoming, where he earns $26,500 annually. He contributes $150 per month to his 401(k), of which his employer matches half of his contribution. Heinlein Hillclimbers contributes $150 per month to his health insurance, $30 per month to his life insurance, and $50 per month to his AD&D policy. He receives a 2% profit-sharing bonus at the end of each year and

$5,250 in tuition reimbursement. Heinlein pays employer-only taxes and insurance that comprises an additional 18% of John's annual salary. What is John's total annual compensation?

A) $26,500.00

B) $39,675.25

C) $40,710.00

D) $39,633.25

C) $40,710.00

You might also like to view...

An employee has gross earnings of $600 and withholdings of $45.90 for social security and Medicare taxes and $60 for income taxes. The employer pays $45.90 for social security and Medicare taxes and $4.80 for FUTA. The total cost of this employee to the employer is

a. $650.70. b. $600.00. c. $696.60. d. $604.80.

The book describes the five levels of the practitioner’s model for human resource management. Of the five, which are you looking forward to studying in this book? Be sure to describe the part of the model in which you have the most interest and why you look forward to learning more about it.

What will be an ideal response?

Recent research has found that ______ hours of sleep a night is the best amount of sleep to function the next day.

A. 6 B. 7 C. 8 D. 8.5

Target costing involves all of the following except:

a. determine what price customers are willing to pay for a product b. subtract all the target margins that supply-chain members want to take off the retail price c. arrive at a target cost by deducting target margins from the price customers are willing to pay d. target certain business units for cost reductions e. design and develop the product so that it meets target cost requirements