What are the primary reasons for and against a policy of "too big to fail."

What will be an ideal response?

The major argument in favor of such a policy is that the failure of some large financial institutions can pose a systemic risk to the financial system. Arguments against such a policy include that it favors large banks over small banks and that it may promote moral hazard.

You might also like to view...

If the demand and supply curves for a commodity both shift to the left by the same amount, then in comparison to the initial equilibrium, the new equilibrium will be characterized by:

A) a higher price quantity. B) the same price and a higher quantity. C) the same price and a lower quantity. D) a lower price and a higher quantity.

Models that focus on factors such as technology shocks rather than "monetary" explanations of fluctuations in real GDP are called

A) rational expectations models. B) real business cycle models. C) short-run macroeconomic models. D) nonmonetary business cycle models.

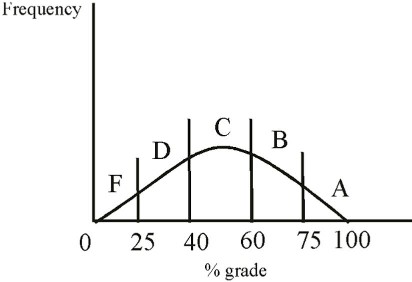

The grade distribution in this class will fit a bell curve as shown below. src="https://sciemce.com/media/4/ppg__rrrr0821190959__f1q42g2.jpg" alt="" style="vertical-align: 0.0px;" height="253" width="427" />

What will be an ideal response? You have no knowledge of what your ability level is relative to the other students and you have no idea how hard the test will be for you. You could fall anywhere on the distribution as far as you know at this time. Now your professor makes you an offer. You have the opportunity to alter the grading brackets to make them anything you want. The only constraint is that the overall class GPA must not change from the 2.0 that is the present distribution. Sketch on the graph below your optimal distribution given these constraints and explain why you made any changes.

You have no knowledge of what your ability level is relative to the other students and you have no idea how hard the test will be for you. You could fall anywhere on the distribution as far as you know at this time. Now your professor makes you an offer. You have the opportunity to alter the grading brackets to make them anything you want. The only constraint is that the overall class GPA must not change from the 2.0 that is the present distribution. Sketch on the graph below your optimal distribution given these constraints and explain why you made any changes.

A tariff can best be described as

A. an excise tax on an imported good. B. a government payment to domestic producers to enable them to sell competitively in world markets. C. an excise tax on an exported good. D. a law that sets a limit upon the amount of a good that can be imported.