List and describe three of the five different lags that can occur which may impede the effectiveness of the use of fiscal policy

Data lag - The time it takes for policymakers to be aware of changes in the economy.

Wait-and-see lag - Rather than act upon a change in the economy immediately, policymakers will generally wait some time period to determine if this is more than just a short-run phenomenon.

Legislative lag - The time it takes for the President and Congress to build political support for a fiscal policy measure and the time it takes to pass this legislation.

Transmission lag - After a fiscal policy measure is enacted, it takes some time for the tax change or spending change to actually take effect.

Effectiveness lag - The time it takes after a policy is put into effect before this action has in impact on the economy.

You might also like to view...

In the above table, suppose imports = $750 billion and government expenditures = $1,000 billion. Hence investment equals

A) -$500 billion. B) $1,000 billion. C) $500 billion. D) $0.

Which of the following is true under natural monopoly?

a. the monopolist will ignore consumers' desires. b. the marginal cost curve will lie below the average total cost curve. c. the monopolist will set price equal to marginal cost and will earn economic profits. d. output is produced under conditions of constant cost.

A supply curve shows

A) the quantities sold at different prices. B) the marginal cost of producing one more unit of a good or service. C) the marginal benefit from buying one more unit of a good or service. D) the total cost of producing different quantities of a good or service.

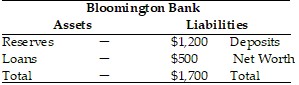

Refer to the information provided in Table 25.5 below to answer the question(s) that follow.

Table 25.5 Refer to Table 25.5. The required reserve ratio is 10%. If the Bloomington Bank is meeting its reserve requirement and has no excess reserves, its reserves equal

Refer to Table 25.5. The required reserve ratio is 10%. If the Bloomington Bank is meeting its reserve requirement and has no excess reserves, its reserves equal

A. $50. B. $70. C. $120. D. $170.