Answer the following statements true (T) or false (F)

In SFAS No. 121, both the recognition and measurement criteria for the impairment of asset event is based on the excess of the carrying value of the asset over its fair market value less costs of disposal.

ANSWER: F

You might also like to view...

Which sentence is expressed correctly?

A) Lee Hartzog wrote the chapter "Observing Native Cultures," which appeared in Communication for Global Markets. B) Lee Hartzog wrote the chapter Observing Native Cultures, which appeared in "Communication for Global Markets." C) Lee Hartzog wrote the chapter Observing Native Cultures, which appeared in Communication for Global Markets.

________ is a risk analysis and forecasting program that uses Monte Carlo simulation

Fill in the blank with correct word.

You deposited ($1,000 ) in a savings account that pays 8 percent interest, compounded quarterly, planning to use it to finish your last year in college

Eighteen months later, you decide to go to the Roshy Mountains to become a ski instructor rather than continue in school, so you close out your account. How much money will you receive? (Round to the nearest whole dollar) A) $1,171 B) $1,126 C) $1,082 D) $1,163 E) $1,008

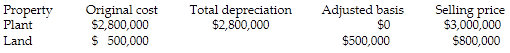

She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

Julie sells her manufacturing plant and land originally purchased in 1980. Accelerated depreciation had been taken on the building, but the building is now fully depreciated. Julie is in the 37% marginal tax bracket. Other information is as follows: