Which inventory cost flow assumption is allowed under U.S. GAAP but not under IFRS? Explain why some U.S. companies will lobby strongly to keep this method as an allowable alternative.

What will be an ideal response?

The following answer points out the key phrases that should appear in students' answers. It is not intended to be an example of complete student response. It might be helpful to provide detailed instructions to students on how brief or in depth you want their answers to be.

LIFO is allowed under U.S. GAAP, but not under IFRS. U.S. companies currently using LIFO will lobby to keep this method because a switch from LIFO would greatly increase taxes for many U.S. companies.

You might also like to view...

Explain the linguistic relativity hypothesis. Give an example to support your answer.

What will be an ideal response?

Refer to Exhibit 4.1. In the absence of the Offshore Assembly Provision of U.S. tariff policy, the price of an imported vehicle to the U.S. consumer after the tariff has been levied is

a. $22,000. b. $23,000. c. $24,000. d. $25,000.

The materials quantity variance, in a standard cost system, is the:

a. Difference between the actual and standard quantities. b. Difference between the actual and standard quantities multiplied by the actual unit price. c. Difference between the actual quantity used and the actual quantity purchased multiplied by the standard unit price. d. Difference between the actual and standard quantities multiplied by the standard unit price.

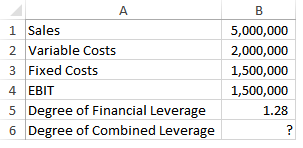

What should be the formula in B6?

a) =B5*(B1-B2)/B3

b) =B5*B1-B2/B4

c) =B5*(B1-B2)/B4

d) =B5*(B2-B3)/B4

e) =B5*(B1-B3)/B4