One way to increase labor force participation is to cut income tax rates. Which of the following is true given such a scenario?

a. Cutting income tax rates increases labor force participation and also allows all other taxes to be cut

b. Cutting income tax rates may force the government to raise other taxes or cut some programs

c. Cutting income tax rates raises more tax revenue and allows for even more government programs

d. Cutting income tax rates puts the burden of the tax cuts on those who now join the labor force.

e. Cutting income tax rates reduces labor force participation.

B

You might also like to view...

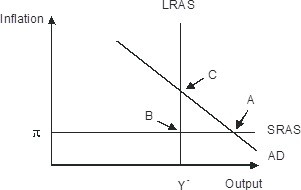

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

The group of economists who believe politicians are subject to the laws of demand and supply and focus on this in their analysis are known as:

A. libertarian economists. B. orthodox economists. C. public choice economists. D. radical economists.

Which statement is correct?

A. During a recession spending on capital goods increases. B. The production of nondurable consumer goods is more stable than the production of durable consumer goods over the business cycle. C. Recessions have not been severe because economists and statisticians have been able to predict their occurrence and intensity with high accuracy. D. Real output and employment usually show little variance over the business cycle.

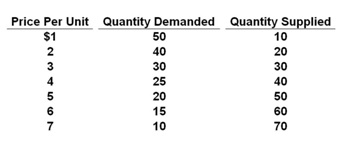

Refer to the table below. What is the equilibrium price and quantity in this market?

The following table gives data for the market for a product.

A. $6 and 60, respectively

B. $5 and 30, respectively

C. $3 and 30, respectively

D. $30 and 3, respectively