As demand and supply become more elastic, taxes reduce market output more and raise less tax revenue. ?

Answer the following statement true (T) or false (F)

True

Rationale: If consumers and producers are very responsible to price changes, their large response to a tax will undermine efforts to raise revenue.

You might also like to view...

Are the owners of taxicabs in New York City earning large profits because the city severely restricts the number of licenses?

A) No, because the city also regulates fares. B) No, because the cost of owning a license absorbs the potential profit. C) Yes, because the number of licenses has not been increased for 50 years. D) Yes, because if they were not the number of taxicabs would decline and profits would rise. E) We cannot tell because profit arises from uncertainty.

Total expenditure equals price times elasticity

a. True b. False Indicate whether the statement is true or false

The following question relates to an oligopoly market where the industry demand curve is P = 100 - Q. What price will the two Stackelberg firms charge?

What will be an ideal response?

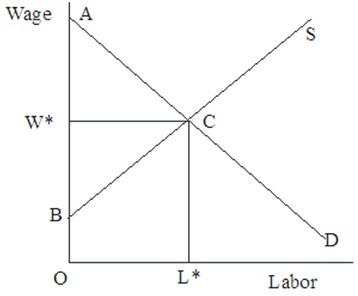

In Figure 45.1, the opportunity cost to workers of working at the equilibrium wage-labor combination is  Figure 45.1

Figure 45.1

A. OW*CL*. B. ABC. C. OBCL*. D. OACL*.