Social Security taxes are

A) progressive because all workers pay the tax.

B) regressive because higher income workers pay taxes on a smaller percentage of their income.

C) proportional because everyone is charged the same percentage tax rate.

D) regressive because higher income workers don't pay the tax.

B

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. Small, medium, and large taxes all affect deadweight loss equally. 2. A large increase in tax can reduce the quantity exchanged to the point where there is very little tax revenue raised. 3. Subsidies create welfare gains. 4. Price ceilings create deadweight losses. 5. Deficiency payment programs are designed to help poor teachers.

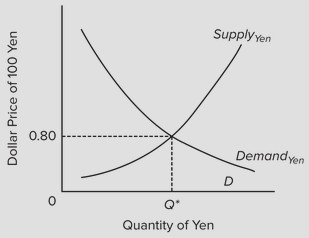

Use the following graph to answer the next question. Assume that Japan and the United States are engaged in a system of flexible exchange rates. An increase in the demand for yen will result in a(n) ________.

Assume that Japan and the United States are engaged in a system of flexible exchange rates. An increase in the demand for yen will result in a(n) ________.

A. appreciation of the U.S. dollar B. decrease in the dollar price of yen C. depreciation of the U.S. dollar D. depreciation of the Japanese yen

In order to gain competitive advantage, it would be more important to encourage a company to invest in ____ factors of production.

Fill in the blank(s) with the appropriate word(s).

A local government currently has a tax base of $4 million and a tax rate of 5 percent. If the tax rate is increased to 6 percent, the tax base will decrease to $3.5 million. If the goal is to maximize tax revenues the tax rate should be

A. reduced to 5 percent. B. abolished. C. lowered below 5 percent. D. kept at 6 percent.