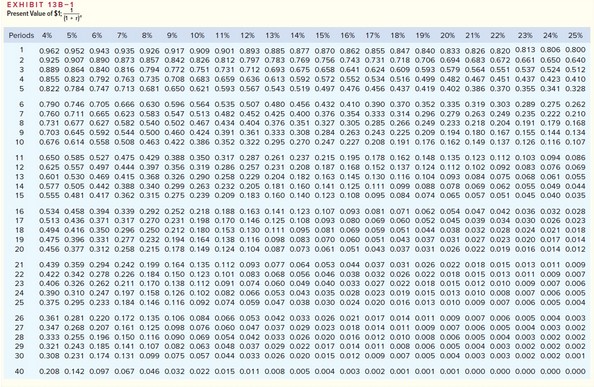

The following information concerning a proposed capital budgeting project has been provided by Jochum Corporation:Use Exhibit 13B-1 to determine the appropriate discount factor(s). Investment required in equipment$200,000?Salvage value of equipment$0?Working capital requirement$40,000?Annual sales$660,000?Annual cash operating expenses$474,000?One-time renovation expense in year 3$60,000? The expected life of the project is 4 years. The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $50,000. Assume cash flows occur at the end

The following information concerning a proposed capital budgeting project has been provided by Jochum Corporation:Use Exhibit 13B-1 to determine the appropriate discount factor(s). Investment required in equipment$200,000?Salvage value of equipment$0?Working capital requirement$40,000?Annual sales$660,000?Annual cash operating expenses$474,000?One-time renovation expense in year 3$60,000? The expected life of the project is 4 years. The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $50,000. Assume cash flows occur at the end

of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.)

A. $178,297

B. $338,800

C. $300,600

D. $136,835

Answer: A

You might also like to view...

Distributive bargaining strategies

A. are used in all interdependent relationships. B. are useful in maintaining long-term relationships. C. can cause negotiators to ignore what the parties have in common. D. are the most efficient negotiating strategies to use.

According to the text, there are several questions you should ask yourself as you decide whether a career in sales is appropriate for you. Which one of the following is LEAST relevant to determining whether a career in sales is best for you?

A. Am I willing to transfer to another city? B. How much freedom do I want in a job? C. How much money do I want to earn? D. Do I have the personality characteristics for the job? E. Do I mind traveling for work?

In some cases, a marketing dashboard can overly rely on ________, putting the focus on what you already know.

A. internal marketing B. inside-out measurement C. partial measurement D. external measurement E. strategic insights

Having high quality schedules for delivery vehicles can lead to?

a. Lower in-transit inventories b. More on-time deliveries c. Both lower in-transit inventories and more on-time deliveries d. Neither lower in-transit inventories nor more on-time deliveries