Joe complains that 32% of his income last year went to taxes. He is referring to his:

A. Average tax rate

B. Marginal tax rate

C. Proportional tax rate

D. Progressive tax rate

A. Average tax rate

You might also like to view...

A public museum is an example of a

A) government-sponsored good. B) public good. C) good which generates a positive externality. D) good which generates a negative externality.

Which of the following best describes the foreign exchange market? It is a market where one country's

a. exports are traded for another country's imports b. currency is traded for that of another c. goods are traded for another country's services d. imports are traded for another country's exports e. services are traded for another country's goods

The first piece of antitrust legislation in the United States to deal with price discrimination was the

a. Clayton Act b. FTC Act c. Cellar-Kefauver Act d. Robinson-Patman Act e. Sherman Antitrust Act

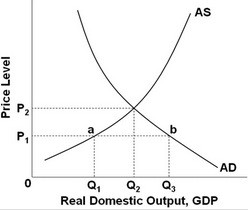

Refer to the above graph. At price level P2:

Refer to the above graph. At price level P2:

A. the quantity of output supplied is constant. B. the quantity of output supplied is less than the quantity of output demanded. C. the quantity of output supplied is greater than the quantity of output demanded. D. the quantity of output supplied is equal to the quantity of output demanded.