Provide two examples of where management override of controls occurred in the Comptronix fraud.

Auditing standards note that there is a possibility that management override of controls could occur in every audit and accordingly, the auditor should include audit procedures in every audit to address that

risk.

The Comptronix case includes several examples of management override of internal control. First,

management avoided making standardized entries in the sales and purchases journal as required by

internal controls and made manual entries (even though not allowed by existing internal controls) to

book the inappropriate transactions. Second, management failed to follow internal controls that required

documentation for equipment purchases. No documents were created for the bogus transactions.

Third, Mr. Shifflett and Mr. Medlin approved payments based solely on an invoice, even though internal

controls required review of the purchase order, receiving report, and invoice before payment could

be approved. Fourth, Mr. Medlin took advantage of weaknesses in the shipping department system

to record bogus transactions and then he destroyed documentation generated by the system for those

transactions so that there no audit trail of those transactions was present.

You might also like to view...

On December 1, 2017, Summit, Inc sold machinery to a customer for $24,000

The customer could not pay at the time of sale but agreed to pay 11 months later and signed a 11-month note at 11% interest. How much interest revenue was earned during 2018? (Round your answer to the nearest dollar.) A) $1,320 B) $2,640 C) $2,420 D) $2,200

Firms HD and LD are identical except for their level of debt and the interest rates they pay on debt?HD has more debt and pays a higher interest rate on that debt. Based on the data given below, what is the difference between the two firms' ROEs? Applicable to Both Firms Firm HD's Data Firm LD's Data Assets$200 Debt ratio50% Debt ratio30% EBIT$40 Interest rate12% Interest rate10% Tax rate25%

A. 2.51% B. 2.65% C. 2.79% D. 2.93% E. 3.07%

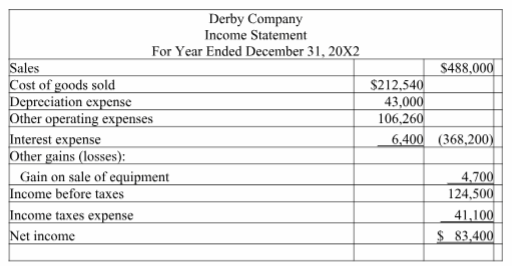

Use the following financial statements and additional information to (1) prepare a complete statement of cash flows for the year ended December 31, 20X2. The cash provided or used by operating activities should be reported using the direct method, and (2) compute the company's cash flow on total assets ratio for 20X2.

Additional Information

a. A $20,000 note payable is retired at its carrying value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $120,000 cash.

d. Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e. Prepaid expenses relate to Other Expenses on the income statement.

f. All purchases and sales of merchandise inventory are on credit.

Which of the following statements best describes the tax consequences of a §338 election?

A. Gain or loss is recognized by the acquired corporation on the deemed sale of its assets, and the buyer gets a stepped-up basis in the assets acquired. B. Gain or loss is recognized by the acquired corporation on the deemed sale of its assets, and the buyer gets a carryover basis in the assets acquired. C. Gain or loss is not recognized by the acquired corporation on the deemed sale of its assets, and the buyer gets a carryover basis in the assets acquired. D. Gain or loss is not recognized by the acquired corporation on the deemed sale of its assets, and the buyer gets a stepped-up basis in the assets acquired.