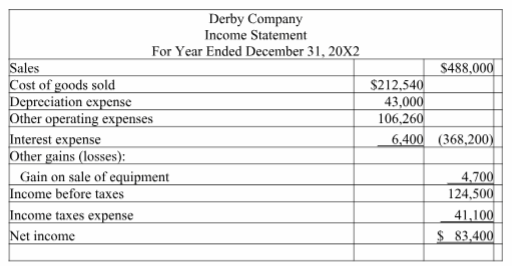

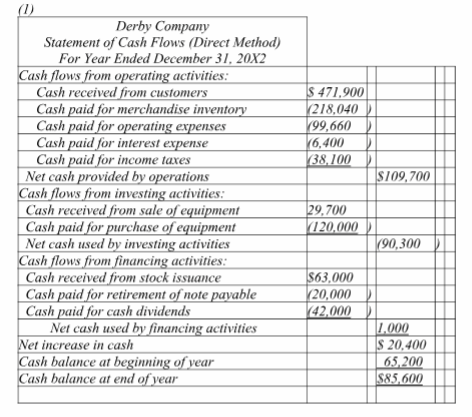

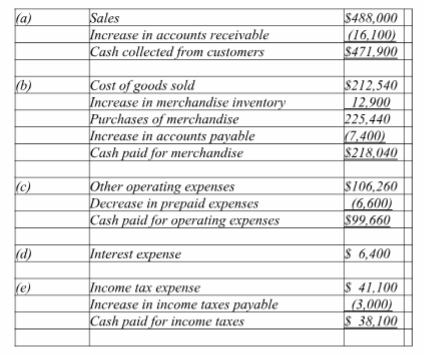

Use the following financial statements and additional information to (1) prepare a complete statement of cash flows for the year ended December 31, 20X2. The cash provided or used by operating activities should be reported using the direct method, and (2) compute the company's cash flow on total assets ratio for 20X2.

Additional Information

a. A $20,000 note payable is retired at its carrying value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $120,000 cash.

d. Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e. Prepaid expenses relate to Other Expenses on the income statement.

f. All purchases and sales of merchandise inventory are on credit.

(2) $109,700/[(522,280+427,480)/2] = 23.1%

You might also like to view...

The most significant flaw in the classical viewpoint is that it

A. overemphasizes mathematical techniques. B. is impractical in the workplace. C. does not address productivity. D. discounts the importance of human needs. E. does not account for irrational behavior.

A trial balance does not identify all types of errors. Which of the following are errors that are not identified using the trial balance?

A)incorrectly recording the transaction amount, but the debits still equal the credits B) incorrectly posting part of a journal entry to the wrong account C) not recording a transaction D) All of these answer choices represent errors that are not identified using the trial balance.

Operating activities are transactions and events associated with selling a product or providing a service

Indicate whether the statement is true or false

Financial management deals with the creation and maintenance of economic value or wealth

Indicate whether the statement is true or false