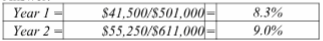

A company reported average total assets of $501,000 in Year 1 and $611,000 in Year 2. Its net operating cash flow in Year 1 was $41,500 and $55,250 in Year 2. Calculate its cash flow on total assets ratio for both years. Comment on the results.

What will be an ideal response?

The company had an increase in net operating cash flow and a corresponding increase in

average total assets over the two-year time period. Its efficiency in the use of its assets to

generate operating cash flow increased over the past year.

You might also like to view...

In the ________ stage of market planning, marketers must determine how they want consumers to think of their product in comparison to competing products

A) develop a mission statement B) perform a situation analysis C) develop marketing strategies D) develop distribution strategies E) implement the plan

Mexico is poised to become the largest auto manufacturing location in the world, thanks to its ______.

A. infrastructure B. political environment C. liberal free trade policies D. legal system

Quantifying the solution can be performed with a cost-benefit analysis or with a(n):

A) frequency analysis B) regression analysis C) feature-benefit presentation D) pricing model E) ROI calculation

According to Shepherd, Shanley, and Porter, which of the following is a small business supra-strategy?

A. Altruism B. Technology C. Scope savings D. Single-mindedness