Suppose you just won the state lottery, and you have a choice between receiving $2,550,000 today or a 20-year annuity of $250,000, with the first payment coming one year from today. What rate of return is built into the annuity? Disregard taxes

a. 7.12%

b. 7.49%

c. 7.87%

d. 8.26%

e. 8.67%

b

You might also like to view...

Which conflict-handling style is selected because a group member has a strong desire to be accepted by other members?

a. compromising b. avoiding c. obliging d. integrating

Which of the following primarily deal with direct goods?

A) e-distributors and independent exchanges B) exchanges and e-procurement Net marketplaces C) exchanges and industry consortia D) e-procurement Net marketplaces and industry consortia

Referencing a walkthrough, the user makes sure that the work product meets the needs of the project's customers

Indicate whether the statement is true or false

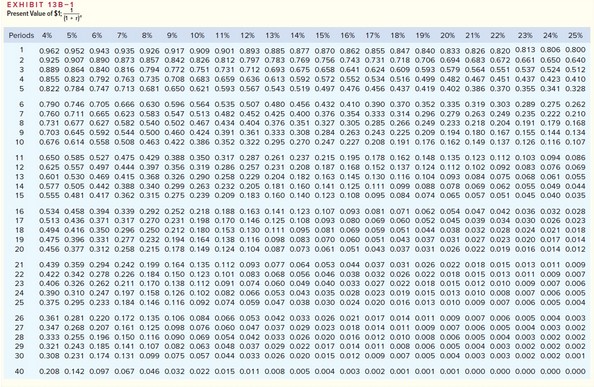

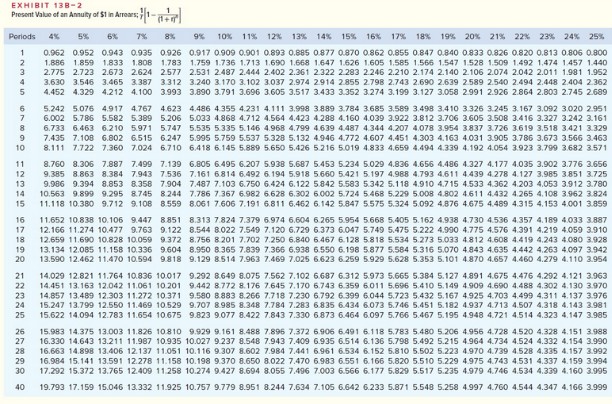

The management of Osborn Corporation is investigating an investment in equipment that would have a useful life of 8 years. The company uses a discount rate of 12% in its capital budgeting. The net present value of the investment, excluding the annual cash inflow, is ?$405,414. To the nearest whole dollar how large would the annual cash inflow have to be to make the investment in the equipment financially attractive? (Ignore income taxes.)Use Exhibit 13B-1 and Exhibit 13B-2 above to determine the appropriate discount

The management of Osborn Corporation is investigating an investment in equipment that would have a useful life of 8 years. The company uses a discount rate of 12% in its capital budgeting. The net present value of the investment, excluding the annual cash inflow, is ?$405,414. To the nearest whole dollar how large would the annual cash inflow have to be to make the investment in the equipment financially attractive? (Ignore income taxes.)Use Exhibit 13B-1 and Exhibit 13B-2 above to determine the appropriate discount

factor(s). A. $81,605 B. $48,650 C. $50,677 D. $405,414