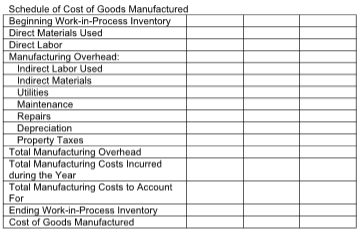

Required: Prepare a schedule of cost of goods manufactured for Varda, Inc. using the format below.

Varda, Inc. used $213,000 of direct materials and incurred $111,000 of direct labor costs during the

year. Indirect labor amounted to $8,100, while indirect materials used totaled $4,800. Other operating

costs pertaining to the factory included utilities of $9,300; maintenance of $13,500; repairs of $5,400;

depreciation of $23,700; and property taxes of $7,800. There was no beginning or ending finished goods

inventory. The Work-in-Process Inventory account reflected a balance of $16,500 at the beginning of the

period and $22,500 at the end of the period.

You might also like to view...

In terms of big data, what includes the scale of data?

A. Velocity B. Volume C. Veracity D. Variety

Lee's 2019 taxable income is $108,000 before considering charitable contributions. Lee is a single individual. She makes a donation of $20,000 to the American Heart Association in December 2019. By how much did Lee's marginal tax rate decline simply because of the donation?

A. 0% B. 10% C. 3% D. 5% E. 8%

Product and brand management is a process concerning the sales and marketing department.

Answer the following statement true (T) or false (F)

An official of a large national union claims that the fraction of women in the union is not significantly different from one-half. Using the critical value approach and the sample information reported below, carry out a test of this statement. Let ? = 0.05. sample size 400 women 168 men 232