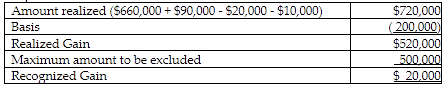

Bob and Elizabeth Brown, a married couple, sell their personal residence to Tamel. Tamel pays $660,000 and assumes their $90,000 mortgage. To make the sale, the Browns pay $20,000 in commissions and $10,000 in legal costs. The couple has owned and lived in the house for seven years and their tax basis is $200,000. What is the amount of gain recognized on the sale?

A) $0

B) $20,000

C) $50,000

D) $520,000

B) $20,000

You might also like to view...

Wildwoods, Inc. earned $1.50 per share five years ago. Its earnings this year were $3.20. What was the growth rate in earnings per share (EPS) over the 5-year period?

A. 15.54% B. 16.36% C. 17.18% D. 18.04% E. 18.94%

The inability to fit more than two earth movers on a construction site at the same time when more are needed to complete the activity on time is an example of a physical constraint.

Answer the following statement true (T) or false (F)

The _______________ Commission has control over swap and futures contracts.

What will be an ideal response?

Gemini Inc. has prepared a market plan for its air conditioners. The managers at Gemini have outlined several activities for their subordinates based on a marketing plan. The employees are required to finish these activities within specific time frames

The managers have also allocated a budget for each activity. In the context of marketing planning, which of the following concepts is illustrated in the scenario? a. Divestment b. Implementation c. Diversification d. Vertical integration