Income tax acts as a shock absorber because

A. it makes disposable income, and thus consumer spending, less sensitive to fluctuations in GDP.

B. it makes disposable income, and thus consumer spending, more sensitive to fluctuations in GDP.

C. it makes disposable income, and thus consumer spending, independent of fluctuations in GDP.

D. none of these.

Answer: A

You might also like to view...

Refer to Figure 13-1. Ceteris paribus, an increase in the growth rate of domestic GDP relative to the growth rate of foreign GDP would be represented by a movement from

A) AD1 to AD2. B) AD2 to AD1. C) point A to point B. D) point B to point A.

Which of the following is not included in M2?

A) Money market mutual funds held by individuals B) Money market deposit accounts C) Money market mutual funds held by institutions D) Small-denomination time deposits

The velocity of money is

a. the rate at which the Fed puts money into the economy. b. the same thing as the long-term growth rate of the money supply. c. the money supply divided by nominal GDP. d. the average number of times per year a dollar is spent.

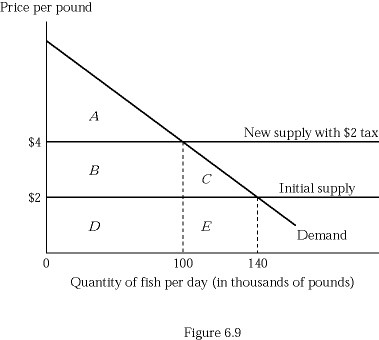

Figure 6.9 depicts a hypothetical fish market with a horizontal supply curve. Suppose the government imposes a tax of $2 per pound of fish, and the tax is paid in legal terms by producers. Which of the following shows the tax revenue raised by the government?

Figure 6.9 depicts a hypothetical fish market with a horizontal supply curve. Suppose the government imposes a tax of $2 per pound of fish, and the tax is paid in legal terms by producers. Which of the following shows the tax revenue raised by the government?

A. Triangle A B. Rectangle B C. Rectangle B + Triangle C D. Rectangle B + Rectangle D