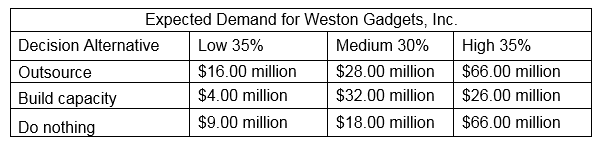

Refer to the data on Expected Demand for Weston Gadgets, Inc. For the various demand scenarios, if you applied the Laplace criterion, what is the lowest payoff?

A. $39.33 million

B. $34.00 million

C. $31.33 million

D. $43.33 million

B. $34.00 million

You might also like to view...

The ending inventory for Wyeth Company was overstated by $6,000 in 2014 . The overstatement will cause Wyeth Company's

a. retained earnings to be understated on the 2014 balance sheet. b. 2015 balance sheet not to be misstated c. cost of goods sold to be overstated on the 2014 income statement. d. cost of goods sold to be understated on the 2015 income statement.

What is the importance of developing a thorough media list? What are the two essential parts of a connector list?

What will be an ideal response?

U.S. GAAP and IFRS require firms to account for correction of errors, if material, by

a. restating net income of prior periods and adjusting the beginning balance in Retained Earnings for the current period. b. restating net income of prior periods and adjusting the ending balance in Retained Earnings for the current period. c. restating net income of the current period and adjusting the beginning balance in Retained Earnings for the current period. d. restating net income of the current period and adjusting the ending balance in Retained Earnings for the current period. e. restating net income of the current period, only.

Becker Billing Systems, Inc., has an antiquated high-capacity printer that needs to be upgraded. The system either can be overhauled or replaced with a new system. The following data have been gathered concerning these two alternatives (Ignore income taxes.): Overhaul Present SystemPurchase New SystemPurchase cost when new$300,000 $400,000 Accumulated depreciation$220,000 - Overhaul costs needed now$250,000 - Annual cash operating costs$120,000 $90,000 Salvage value now$90,000 - Salvage value in ten years$30,000 $80,000 Working capital required - $50,000 Refer to Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided.The company uses a 10% discount rate and the total-cost approach to capital budgeting analysis. The

working capital required under the new system would be released for use elsewhere at the conclusion of the project. Both alternatives are expected to have a useful life of ten years.The net present value of the new system alternative is closest to: A. $(987,400) B. $(758,400) C. $(552,900) D. $(862,900)