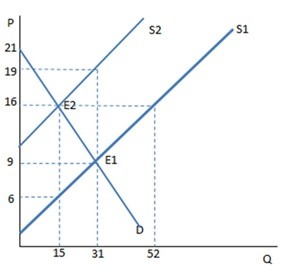

Suppose a tax on sellers has been imposed as shown in the graph. Once the tax is in place, the buyers experience:

Suppose a tax on sellers has been imposed as shown in the graph. Once the tax is in place, the buyers experience:

A. a decrease in demand.

B. an increase in quantity demanded.

C. a decrease in quantity demanded.

D. an increase in demand.

Answer: C

You might also like to view...

George purchased a $10,000 bond that pays a nominal interest rate of 8 percent per year. George's marginal income tax rate is 28 percent. Over the last year, inflation was 3 percent

Find George's before-tax real interest rate and his after-tax real interest rate.

Refer to Figure 16-11. If government purchases increase by $100 billion and lead to an ultimate increase in aggregate demand as shown in the graph, the difference in real GDP between point A and point B will be

A) more than $100 billion. B) less than $100 billion. C) $100 billion. D) There is insufficient information given here to draw a conclusion.

Why can a monopoly make a positive economic profit even in the long run?

What will be an ideal response?

A natural monopolist will voluntarily choose to produce at the point where P = MC

a. True b. False Indicate whether the statement is true or false