The Duval Corporation has recently evaluated a proposal to invest in cost-reducing production technology. According to the evaluation, the project would require an initial investment of $17,166 and would provide equal annual cost savings for five years. Based on a 10 percent discount rate, the project generates a net present value of $1,788 . The project is not expected to have any salvage value

at the end of its five-year life. Refer to Duval Corporation. What are the expected annual cost savings of the project? Present value tables or a financial calculator are required.

a. $3,500

b. $4,000

c. $4,500

d. $5,000

D

Net Present Value = $ 1,788

Initial Investment = 17,166

PV of Cash Inflows = 18,954

Use PV of Annuity Table (5 years, 10% discount); Constant = 3.7908

$18,954 / 3.7908 = $5,000

You might also like to view...

The procedure to gather, integrate, apply, and store information related to specific subject areas is _____

a. a retail information system b. data-base management c. marketing research d. data storage

A(n) ________ word is one capable of having more than one meaning in the context of certain facts

A) ambiguous B) definite C) certain D) hypothetical

What is the major benefit of closely aligning the corporate culture with the requirements for proficient strategy execution?

A. A good strategy-culture alignment that enhances a company's cost competitiveness. B. A tight strategy-culture alignment that enhances the creation of core competencies and distinctive competencies. C. A tight strategy-culture alignment that makes it easier to change a company's culture over time-as a company's strategy evolves, the culture automatically evolves too. D. A good strategy-culture alignment that makes it possible to establish a much bolder strategic vision and strategic intent. E. A tight strategy-culture fit that steers company personnel into displaying behaviors and adopting operating practices that promote good strategy execution.

Which of the following statements is correct?

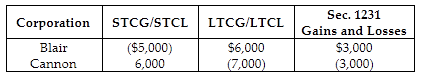

Blair and Cannon Corporations are members of an affiliated group. No prior net Sec. 1231 losses have been reported by any group member. The two corporations report consolidated ordinary income of $100,000 and gains and losses from property transactions as follows.

A) The consolidated group reports a net short-term capital gain of $1,000.

B) Blair Corporation's separate return reports a $4,000 net long-term capital gain.

C) Cannon Corporation's separate return reports a $1,000 net long-term capital loss.

D) All three of the above are correct.