Capital goods, because their purchases can be postponed like ______ consumer goods, tend to contribute to ________ in investment spending

A. nondurable; instability

B. nondurable; stability

C. durable; instability

D. durable; stability

C. durable; instability

You might also like to view...

There has been a downward trend in the United States since 1980 in the ambient concentrations of

a. sulfur dioxide. b. carbon monoxide. c. lead. d. all of the above.

Which of the following items is counted as part of government purchases?

a. The federal government pays $2,000 in Social Security benefits to a retired person. b. The city of Athens, Ohio pays $10,000 to a tree-trimming firm to trim trees along city boulevards. c. The state of Nebraska pays $1,000 to help a low-income family pay its medical bills. d. All of the above are correct.

According to the new classical theory, if the public correctly anticipates a government policy to increase aggregate demand, then

A) there will be a short-run tradeoff between inflation and unemployment, but there will not be a long-run tradeoff. B) there will be a long-run tradeoff between inflation and unemployment, but there will not be a short-run tradeoff. C) there will be both a long-run and a short-run tradeoff between inflation and unemployment. D) there will be neither a long-run nor a short-run tradeoff between inflation and unemployment. E) there may be a short-run tradeoff between inflation and unemployment, but one cannot say for certain whether there will be a long-run tradeoff.

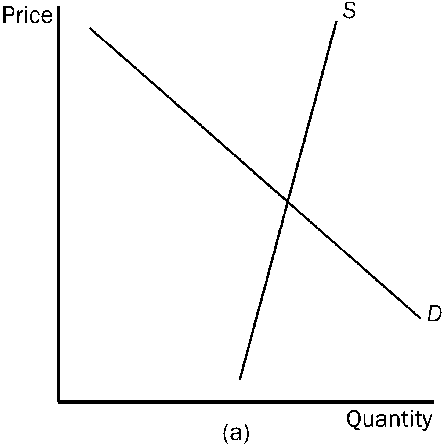

Figure 4-23

Refer to . In which market will the majority of the tax burden fall on the seller?

a.

market (a)

b.

market (b)

c.

market (c)

d.

All of the above are correct.