All of the following are income tax disclosures required by GAAP except:

A) total deferred taxes from permanent differences and from temporary differences.

B) total deferred tax assets and total deferred tax liabilities.

C) total valuation allowance and net change in the allowance.

D) causes of deferred tax assets and deferred tax liabilities.

A

You might also like to view...

Briefly describe the different types of pricing objectives

What will be an ideal response?

Which of the following is the best example of the control objective in the revenue cycle that all transactions are recorded accurately?

a. Sales are recorded at the invoice price expected to be collected from customers. b. Sales orders have sequential numbering. c. Recorded sales transactions are evidenced by valid invoices and shipping documents. d. Credits to customer accounts are classified as liabilities.

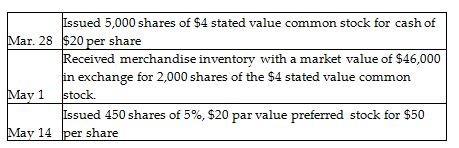

Budget Office Supply Corporation completed the following stock issuance transactions:

Prepare the journal entries to record these transactions. Explanations are not required.

A grocery store chain with a high current ratio but a low quick ratio probably does not have a serious liquidity problem and would likely have little trouble selling inventory to meet the obligations of current liabilities

Indicate whether the statement is true or false