Securitization:

A. is a promise by the bond issuer to repay the loan, at a specified maturity date, and to pay periodic interest at a specific percentage rate.

B. is an agreement in which a lender gives money to a borrower in exchange for a promise to repay the amount loaned plus an agreed-upon amount of interest.

C. turns many loans into a risk-free secure asset.

D. turns many loans into a single larger asset.

Answer: D

You might also like to view...

If in Switzerland in January, 2009 the CPI was 187.4 and in January, 2010 it was 191.1, then the inflation rate in 2010 was

A) 1.9 percent. B) 3.7 percent. C) -1.9 percent. D) unknown without the base period index number. E) unknown without the real prices.

Deciding which exchange rate should be used in the presentation of financial statements

A) is a rather straight forward decision. B) is called exchange rate risk. C) is called market-based exposure. D) is called balance sheet exposure.

A _________ card is an instruction to the user’s bank to transfer money directly and immediately from your bank account to the seller.

a. smart b. debit c. credit d. money

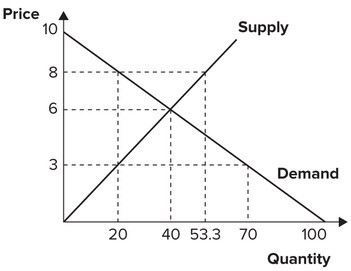

Refer to the graph shown. With an effective price ceiling at $3, the quantity supplied:

A. falls from 40 to 20. B. increases from 20 to 40. C. increases from 40 to 70. D. falls from 70 to 40.