Arnold Harberger's study on the incidence of the corporate income tax concluded that the burden of the tax is borne

A. by consumers in the form of higher prices and by workers in the form of lower wages.

B. by corporations in the form of lower profits and by consumers in the form of higher prices.

C. by owners of corporations, proprietorships, and partnerships in rough proportion to profits.

D. only by noncorporate firms in the form of higher capital prices.

Answer: C

You might also like to view...

An increase in demand shifts the demand curve to the left

a. True b. False Indicate whether the statement is true or false

When a nation's international borrowing is positive, then its national saving ________ its national investment.

A) exceeds B) equals C) is less than

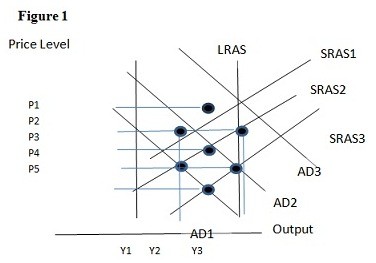

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

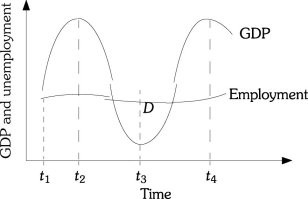

Refer to the information provided in Figure 30.2 below to answer the question(s) that follow. Figure 30.2Refer to Figure 30.2. Labor productivity at time t2 is

Figure 30.2Refer to Figure 30.2. Labor productivity at time t2 is

A. less than labor productivity at time t1. B. larger than labor productivity at time t3. C. less than labor productivity at time t3. D. less than labor productivity at time t4, but larger than labor productivity at time t3.