In the short run, a perfectly competitive firm is producing an output level where marginal cost equals $10, average total cost equals $7, and marginal revenue equals $9 . Which of the following statements is correct?

a. The firm is earning an economic profit which could be increased by raising output.

b. The firm is earning an economic profit which could be increased by lowering output.

c. The firm is maximizing its economic profit.

d. The firm is suffering an economic loss which could be decreased by raising output.

e. The firm is suffering an economic loss which could be decreased by lowering output.

B

You might also like to view...

The marginal firm in a competitive market will earn zero economic profit in the long run

a. True b. False Indicate whether the statement is true or false

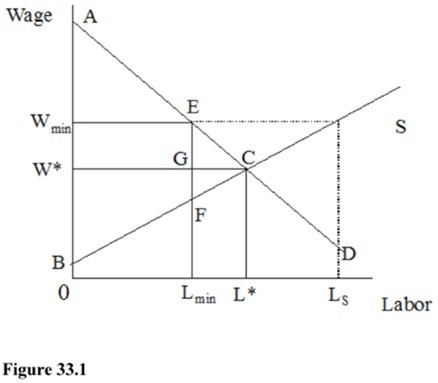

In Figure 33.1, at the minimum wage, the producer surplus is

A. BWminEF. B. WminAE. C. BW*C. D. W*AC.

Suppose there are two types of bonds (one-year bonds and two-year bonds) and that the yield curve is initially upward sloping in period t. Note: For this question assume that: (1 ) expected inflation is zero; and (2 ) the relevant interest rate on the vertical axis of the IS-LM model is the one-year interest rate. Based on our understanding of the IS-LM model, of the yield curve and of financial

markets, we know with certainty that an announcement in period t of a partially unexpected future increase in taxes (to be implemented in period t + 1 ) will have which of the following effects? A) stock prices will increase in period t B) stock prices will fall in period t C) the yield curve will become steeper in period t D) none of the above

If a tax (paid by consumers) is levied on a good, this would

A. move its demand curve to the right. B. cause a movement along the demand curve to a (higher price, lower quantity) point. C. move its demand curve to the left. D. cause a movement along the demand curve to a (lower price, higher quantity) point.