Which of the following statements is CORRECT?

A. The use of debt financing will tend to lower the basic earning power ratio, other things held constant.

B. A firm that employs financial leverage will have a higher equity multiplier than an otherwise identical firm that has no debt in its capital structure.

C. If two firms have identical sales, interest rates paid, operating costs, and assets, but differ in the way they are financed, the firm with less debt will generally have the higher expected ROE.

D. The numerator used in the TIE ratio is earnings before taxes (EBT). EBT is used because interest is paid with post-tax dollars, so the firm's ability to pay current interest is affected by taxes.

E. Other things held constant, increasing the total debt to total capital ratio will increase the ROA.

Answer: B

You might also like to view...

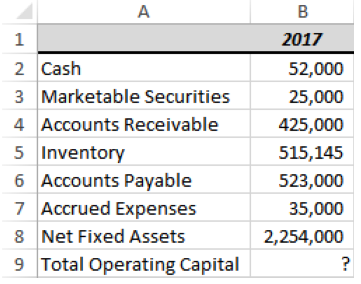

What should be the formula in cell B9?

a) =SUM(B2:B5)-SUM(B6:B7)+B8

b) =B2+SUM(B4:B5)-SUM(B6:B7)+B8

c) =(B2+B4+B5)+B8-(B5+B6 +B7)

d) =(B2+B4+B5)-B8+(B5+B6)

e) =(B2+B4+B5)+B8-(B6+B7)

Codes of ethics for public relations practitioners have little impact unless they are accepted and applied by their employers

Which two of the following practices is NOT used by public relations firms to encourage ethical practice among their employees? A. Holding regular training sessions on ethical issues D and

What crimes do not require mens rea?

A) felonies B) strict liability crimes C) street crimes D) petty crimes

What is not suggested by the textbook to help combat culture shock?

a. Make sure the job you will be doing is clear from the very beginning b. Talk to people who have been in that country to get their advice and feedback c. Research the culture and the language d. Try not to create cultural bias by researching the new culture