For direct price discrimination to work

a. The firm need not be able to identify the members of the low-value group

b. The firm be able to charge the low-value customers a lower price than the higher-value customers

c. The firm need not worry about any arbitrage since all its customers are charged the same price

d. It needs to be too complicated for the customers to understand

b

You might also like to view...

Which of the following best describes how economists test the empirical predictions of economic models?

A) Economists survey individuals to learn about how people think through decisions about how much to purchase or to produce. B) Economists collect and analyze real-world observations of people's actions to discern if those actions accord with theories' predictions. C) Based on theories about thought processes, economists seek to determine which thought processes predominate in determining how a person decides what actions to take. D) Recognizing that people always do what they say they will do, economists rely exclusively on information gleaned from polls and surveys conducted by poll takers and market researchers.

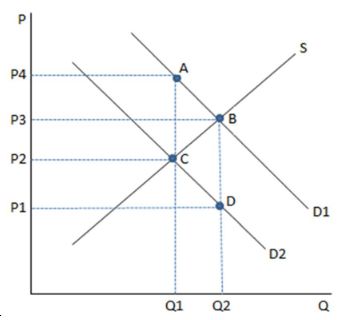

This graph depicts a tax being imposed, causing demand to shift from D1 to D2. According to the graph shown, the tax caused:

A. an increase in consumption from Q1 to Q2.

B. a decrease in consumption from Q2 to Q1.

C. a decrease in the price consumers pay from P3 to P1.

D. a decrease in the price the suppliers receive from P3 to P1.

Exports minus imports equals net exports.

Indicate whether the statement is true or false

Which of the following statements concerning a pure public good is false?

A. It is impossible to exclude non-taxpayers from the enjoyment of the public good B. All benefits associated with the production and use of a public good are received by the government C. The availability of a public good to one person simultaneously makes it available to all members of society D. The private sector does not have an economic incentive to produce a socially optimal amount of a public good