Both formal and informal rule-making processes include public hearings

Indicate whether the statement is true or false

False

You might also like to view...

With improvisation, the following statements are true EXCEPT ______.

a. improvisation is not just for actors or musicians b. there’s no such thing as being wrong c. nothing suggested is questioned or rejected d. everything is unimportant

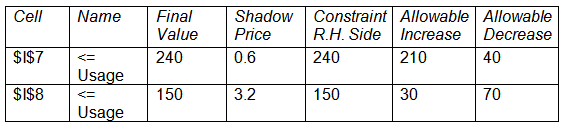

Consider the portion of the sensitivity analysis report that follows. Decreasing the right-hand side constraint by 1 unit for $I$8 (from 150 to 149) will result in which of the following?

a. decrease the profit by $0.6

b. increase the profit by $3.2

c. increase the profit by $0.6

d. decrease the profit by $3.2

After your financial plan is developed it should be

A) locked in a safe for keeping so it isn't stolen. B) reviewed every five years. C) monitored and updated annually. D) sold to others.

Answer the following statements true (T) or false (F)

1. Section 1250 does not apply to assets sold or exchanged at a loss. 2. In addition to the normal recapture rules of Sec. 1250, corporations which sell depreciable real estate are subject to additional recapture rules of Sec. 291. 3. The additional recapture under Sec. 291 is 25% of the difference between the amount that would have been recaptured if the property was Sec. 1245 property and the actual recapture under Sec. 1250. 4. Frisco Inc., a C corporation, placed a building in service in 2002 and deducted straight-line depreciation under the MACRS system in the normal manner. It sold the building this year for a substantial gain. Because straight-line depreciation was used, Frisco will not need to recognize any ordinary gain. 5. Trena LLC, a tax partnership owned equally by Trent and Nina, sells a building it had placed in service five years ago. Sec. 291 will require that part of the gain (up to 20% of accumulated depreciation) be treated as ordinary gain, with the balance treated as Sec. 1231 gain.