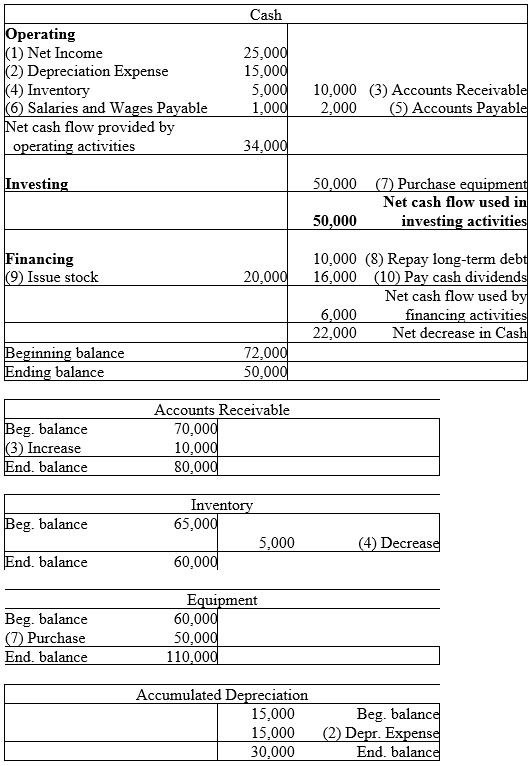

The management team of Wickersham Brothers Inc. is preparing its annual financial statements. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statements are summarized. Current YearPrior Year ??Balance Sheet ??Assets ??Cash $50,000 $72,000 ??Accounts Receivable 80,000 70,000 ??Merchandise Inventory 60,000 65,000 ??Property and Equipment 110,000 60,000 ??Less: Accumulated Depreciation (30,000) (15,000) ??Total Assets $270,000 $252,000 ??Liabilities: ??Accounts Payable $10,000 $12,000 ??Salaries and

Wages Payable 2,000 1,000 ??Notes Payable, Long-Term 50,000 60,000 ??Stockholders' Equity: ??Common Stock 100,000 80,000 ??Retained Earnings 108,000 99,000 ??Total Liabilities and Stockholders' Equity $270,000 $252,000 ??? Current Year ?Income Statement ?Sales$200,000 ?Cost of Goods Sold 110,000 ?Depreciation Expense 15,000 ?Other Expenses 50,000 ?Net income$25,000 ?? Other information from the company's records includes the following:• Bought equipment for cash, $50,000.• Paid $10,000 on long-term note payable.• Issued new shares of common stock for $20,000 cash.• Cash dividends of $16,000 were declared and paid to stockholders.• Accounts Payable arose from inventory purchases on credit.• Income Tax Expense ($4,000) and Interest Expense ($3,000) were paid in full at the end of both years and are included in Other Expenses.Required:Prepare a schedule summarizing operating, investing, and financing cash flows using the T-account approach.

What will be an ideal response?

You might also like to view...

Purchased intangible assets are generally expensed at their acquisition costs because the future economic benefits associate with them are difficult to measure

Indicate whether the statement is true or false

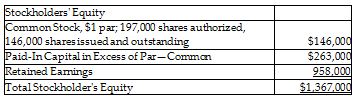

On June 30, 2018, Padres, Inc. showed the following data on the equity section of their balance sheet:

On July 1, 2018, the company declared and distributed a 10% stock dividend. The market value of the stock at that time was $15 per share. Following this transaction, what is the number of shares issued?

A) 86,500

B) 297,300

C) 160,600

D) 146,000

Answer the following statements true (T) or false (F)

1. The work breakdown structure identifies the individual work packages necessary to accomplish the project. 2. The time-phased budget enables the project team to determine when budgeted money is likely to be spent on completion of tasks. 3. The project’s baseline is the standard against which we compare project performance, project cost, and project schedule. 4. Unlike the standard S-curve evaluation, the EVM variance is meaningful because it is based not simply on the budget spent but on value earned. 5. The work breakdown structure identifies the human and material resources assigned to the project.

A mechanism for holding nonprofit organizations accountable is ______.

A. lucidity B. autocracy C. transparency D. impenetrability