Suppose that equilibrium in the dollar-pound market occurs where 300 million pounds are demanded at a price of $1.75 per pound. If the current exchange rate is $1.60 per pound, we know that

a. the dollar-pound market is in equilibrium

b. there is an excess demand for pounds, so the dollar price of the pound will rise

c. there is an excess demand for pounds, and the pound is overvalued

d. there is an excess supply of pounds, and the dollar price of the pound will rise

e. there is an excess supply of pounds, and the dollar price of the pound will fall

B

You might also like to view...

"If Ivan says he is indifferent between the consumption of a new pair of jeans or a set of earrings, he means that he does not want either product." Is the previous analysis CORRECT? Explain your answer

What will be an ideal response?

If the MPS = .25, and investment falls from $100 to $75, real GDP will decrease by:

A. $75. B. $100. C. $125. D. $150.

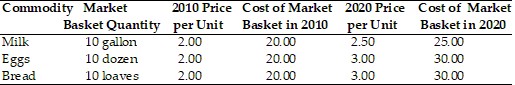

Considering the data in the table shown above and 2010 as the base year, what is the inflation rate between years 2010 and 2020?

Considering the data in the table shown above and 2010 as the base year, what is the inflation rate between years 2010 and 2020?

A. 3.4 percent B. 41.7 percent C. 17.1 percent D. 0.0 percent

Suppose a particular bank is very large in terms of assets, and makes consumer and residential loans as well as commercial and industrial loan. The bank is probably a:

A. regional or super-regional bank. B. money center bank. C. savings bank. D. community bank.