McCurdy Co.'s Class Q bonds have a 12-year maturity, $1,000 par value, and a 5.75% coupon paid semiannually (2.875% each 6 months), and those bonds sell at their par value. McCurdy's Class P bonds have the same risk, maturity, and par value, but the P bonds pay a 5.75% annual coupon. Neither bond is callable. At what price should the annual payment bond sell?

A. $943.98

B. $968.18

C. $993.01

D. $1,017.83

E. $1,043.28

Answer: C

You might also like to view...

The lower the inventory turnover ratio, the less time inventory resides in storage

a. True b. False Indicate whether the statement is true or false

The difference between the price consumer's pay and the amount they would actually have been willing to pay to obtain the benefits is known as ____________

a. net value b. gross value c. consumer surplus d. moderate value e. consumer demand

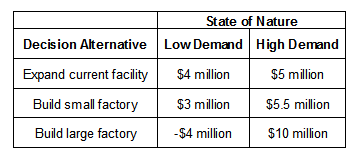

ABC operates a factory in the United Kingdom. Because the company’s existing factory doesn’t have the capacity to meet the future demands, it is considering various options. Consider the payoff matrix that shows the payoff for each combination of decision and state of nature. Determine the best alternative using the maximax criterion.

a. Expand current facility.

b. Build small factory.

c. Build large factory.

d. Determine a new alternative.

Carlsberg’s development features a complex pattern of inward overseas investment, transnational alliances and joint ventures that later it acquires. Why choose this strategy? Why do prospective partners engage with Carlsberg, given its seemingly predatory instinct for 100% ownership and control?

What will be an ideal response?