Which of the following is true of the capital-gains tax rates?

A. Lower rates of tax encourage tax avoidance.

B. Higher rates of tax encourage tax avoidance.

C. Lower rates of tax discourage realization.

D. Higher rates of tax encourage realization.

Answer: B

You might also like to view...

Government regulations:

A. always seek to increase competition. B. sometimes protect monopoly power in certain industries. C. never protect monopoly rights. D. usually are ineffective.

Which of the following items is likely to have the highest positive income elasticity of demand?

a. Bread b. Jewelry c. Soap d. A plumber's service e. Table salt

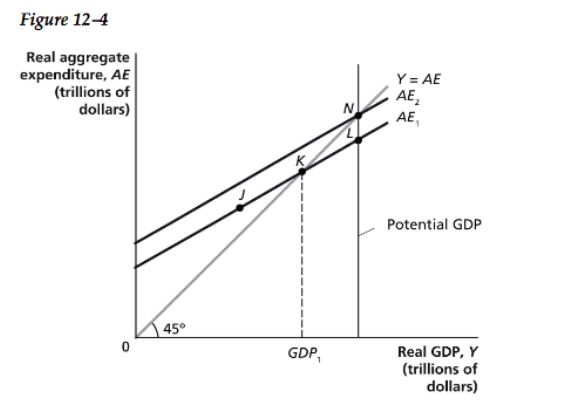

Refer to Figure 12-4. Potential GDP equals $500 billion. The economy is currently producing GDP 1 which is equal to $450 billion. If the MPC is 0.8, then how much must autonomous spending change for the economy to move to potential GDP?

A) -$40 billion

B) -$10 billion

C) $10 billion

D) $40 billion

With a nominal interest rate of 5%, the present discounted value of $100 to be received in one year is

A) $90.91. B) $95.23. C) $181.82. D) $190.00. E) $220.00.