During 1981-1985, the United States pursued a restrictive monetary policy that sharply lowered inflation. At the same time, large budget deficits helped push real interest rates to an all-time high. What would you expect to happen to the value of the dollar on the foreign exchange market?

Both the lower inflation rate and higher real interest rates should have increased the demand for the dollar, causing an appreciation relative to other currencies. This is precisely what happened. .

You might also like to view...

Economic growth is the result of all of the following EXCEPT

A) technological change. B) capital accumulation. C) opportunity cost. D) investment in human capital.

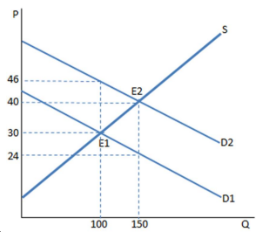

The graph shown portrays a subsidy to buyers. The deadweight loss arising from the subsidy is:

A. $400.

B. $3,600.

C. $750.

D. $800.

Suppose that a country that has a high average wage level agrees to trade with a country that has a low average wage level. Which country can benefit?

a. only the one with a low level of output per person. b. only the one with a high level of output per person. c. both d. neither

The infant industry argument is valid if the present value of the stream of national benefits is less than the present value of the stream of national costs.

Answer the following statement true (T) or false (F)