Which of the following multiplier concepts is most important from the point of view of devising an activist policy?

A) the income and money-creation multipliers

B) the dynamic multipliers, that is the timing of multiplier effects given a policy change

C) the long-term multipliers, that is the total effect from several time periods given a policy change

D) the money-creation multiplier

B

You might also like to view...

In bringing an economy out of a recession, a government will often resort to ________ fiscal policies, which often results in budget deficits

A) conservative B) innovative C) contractionary D) expansionary

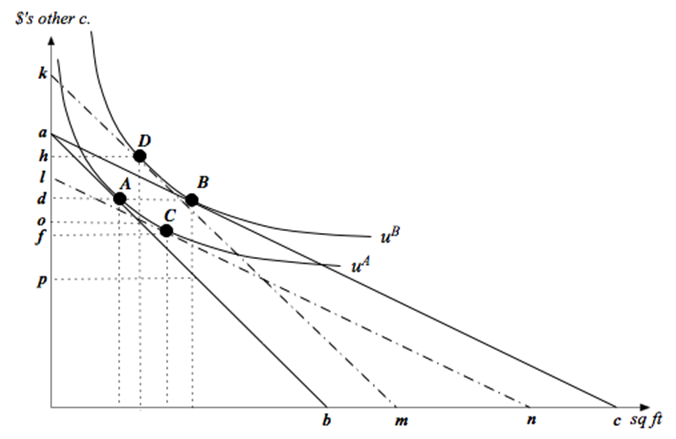

Consider a household with income I and two goods to choose from - square feet of housing (x1) and dollars of other consumption (x2). The annual price per square foot of housing is p, and the household's tastes can be described by the utility function u(x1,x2)= x10.25x20.75. a. How much housing and other goods will the household demand as a function of p and I. b. Suppose income is $100,000 and the price of housing is $10 per square foot. Then the government introduces a subsidy that lowers the housing price to $5 per square foot. In the attached graph, let the solid lines denote the budget lines of the household before and after the subsidy. What are the values of the intercept terms a, b and c in the graph?

c. How much of each good does the household consume at bundle A- i.e. what are the values of d and e in the graph. How much would the household consume of each good after the subsidy?

d. Answer this part in terms of letters on the vertical axis of the graph. What is the most this household would be willing to pay in cash to get this price subsidy? If a household already had the subsidy (without having paid any cash to get it), what is the least that we would have to pay the household in cash for the household to be willing to give up the subsidy?

e. The expenditure function for this household is approximately E(p,u)=1.755p0.25u. Calculate dollar values for the first question in part (d).

f. What is the dollar value for the second question in part (d)?

g. If the subsidy is put in place (without the household making any cash payments to get it), how much will the subsidy cost the government? Express this as a distance in the graph as well as a dollar value.

h. Explain intuitively why there is a deadweight loss of implementing the subsidy - and then calculate the dollar value of the deadweight loss.

i. Calculate the bundles C and D in the graph - i.e. calculate the values for f, g, h and i. (Hint: You can do this a number of different ways - but the quickest way would be to use your answers to parts (e) and (f).)

What will be an ideal response?

Income elasticity of demand reflects

A) the change in total quantity demanded divided by the total change in income. B) the responsiveness of the quantity demanded to changes in income, adjusting its relative price so real income does not change. C) the responsiveness of income of producers to a change in quantity sold of the good. D) the responsiveness of demand to changes in income.

A decision to supply labor or not to supply it is also a decision to

A. earn the highest possible wage. B. demand or forgo a certain amount of leisure. C. be as productive as possible. D. join the union.