Suppose fairness is defined as those with the highest incomes can afford to pay a greater proportion of their income in taxes. Then which of the following taxation systems would be consistent with this notion of fairness?

A. A true flax tax.

B. A flat sales tax on consumption purchases.

C. A progressive tax on income.

D. A fixed federal tax of $5,000 that everyone pays regardless of income status.

Answer: C

You might also like to view...

With respect to events like global warming, some economists suggest using falling discount rates because

A) exponential discounting virtually gives no weight to (large) costs incurred far into the future. B) exponential discounting weights (large) costs incurred far into the future heavily. C) events far in the future do not affect us. D) we should not care about costs far in the future.

Consumption spending includes:

a. durable goods, nondurable goods, and housing. b. durable goods, nondurable goods, and imports. c. durable goods, services, and housing. d. durable goods, nondurable goods, and services. e. nondurable goods, services, and housing.

Taxing interest, dividends, and estates ______ the cost of saving versus consumption.

a. equalizes b. decreases c. increases d. eliminates

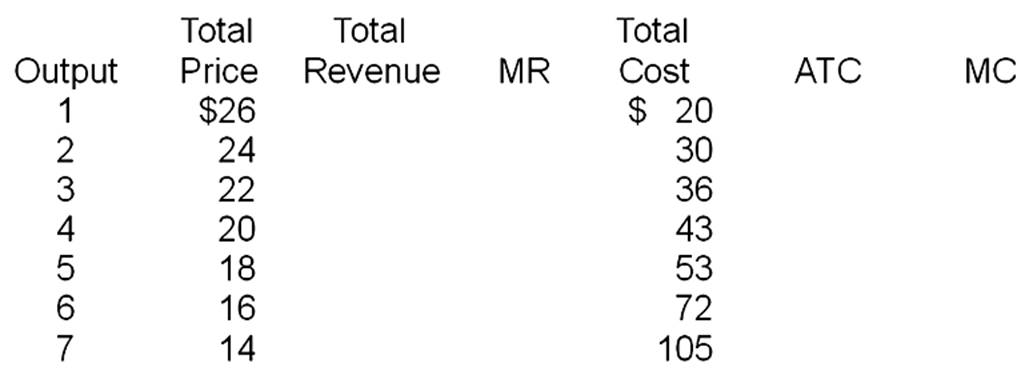

(a) Fill in table. (b) Using your own piece of graph paper, draw a graph of the firm's demand, marginal revenue, marginal cost, and average total cost curves. (c) Calculate the firm's total profit. (d) If the firm operates at optimum efficiency, how much will its output be? (e) If the firm were a perfect competitor, how much will its price be in the long run?