Prepare the 2018 statement of cash flows, using the indirect method.

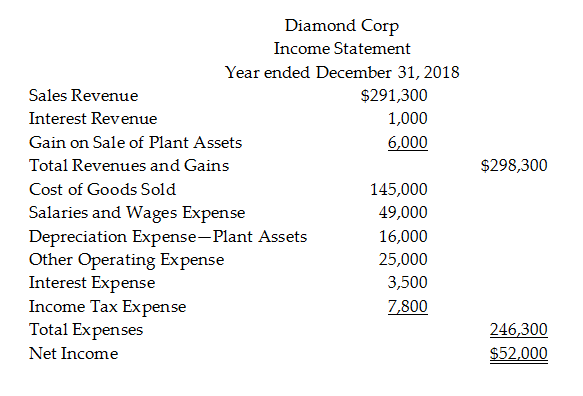

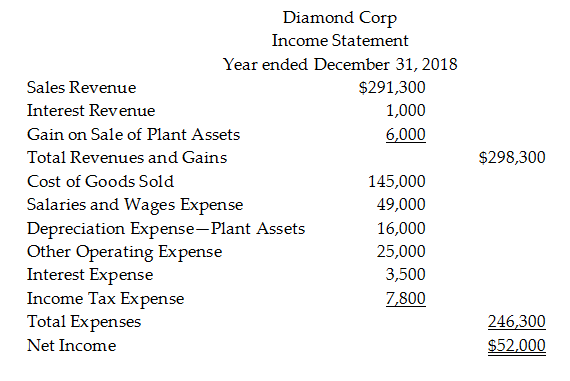

Diamond Corp. has provided the following information for the year ended December 31, 2018.

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net book value of $10,000 was sold for $16,000.

Depreciation expense of $16,000 was recorded during the year.

During 2018, the company repaid $43,000 of long-term notes payable.

During 2018, the company borrowed $34,000 on a new long-term note payable.

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

You might also like to view...

The payment equity for a service is a range from the minimum level of service consumers are willing to accept to the level they believe can and should be delivered

Indicate whether the statement is true or false

Auburn Inc., a publishing company, realized that there was a factual error in the August issue of its business magazine, Alacrity. The magazine’s editor-in-chief immediately released a press statement apologizing for the error. Subsequently, Auburn published the actual figures in Alacrity’s September issue. Which of the following management functions was used in this scenario?

a. Controlling b. Leading c. Planning d. Motivation

In a ________, you are the single owner for the venture and you have full responsibility for the ventures operations

a. C Corporation b. S Corporation c. Limited Liability Company (LLC) d. Sole Proprietorship

Brandon orally assigned his right to $100 from a lawn mowing contract to Will as a gift. This assignment is:

a. not valid because it was not in writing. b. valid even though it was oral and there was no consideration from Will. c. irrevocable once Brandon has told Will about the gift. d. not valid because Will gave no consideration for the assignment.