What is fiscal policy, and who is responsible for fiscal policy?

What will be an ideal response?

Fiscal policy refers to changes in federal taxes and purchases that are intended to achieve macroeconomic policy objectives. Congress and the president are responsible for fiscal policy.

You might also like to view...

If the demand curve for slices of pizza is given as Q = 300 - 16p, then the point elasticity of demand when price is $1.50 is

A) -24. B) -16. C) -0.0054. D) -0.087.

An economy can have an abundant supply of labor, capital, and natural resources but still produce goods and services inefficiently

Indicate whether the statement is true or false

If there are two goods and two countries, then one country can have

A) a comparative advantage in only one good. B) a comparative advantage in both goods. C) a higher opportunity cost of producing both goods. D) a lower opportunity cost of producing both goods.

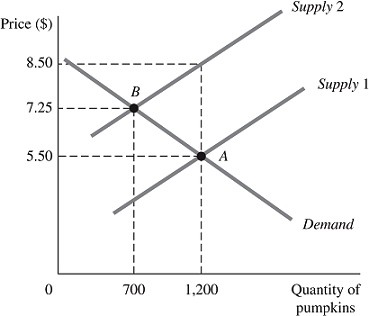

Refer to the information provided in Figure 5.7 below to answer the question(s) that follow.

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. The total revenue the government will receive from the imposition of this tax is

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. The total revenue the government will receive from the imposition of this tax is

A. $875. B. $1,225. C. $2,100. D. $3,600.