If you sell a $100,000 interest-rate futures contract for 110, and the price of the Treasury securities on the expiration date is 106, your ________ is ________

A) profit; $4000

B) loss; $4000

C) profit; $6000

D) loss; $6000

A

You might also like to view...

A perfectly competitive market is in equilibrium and 100,000 units are being produced. If three firms take over this market and a Cournot oligopoly is formed, what is the new total equilibrium quantity produced?

A) 75,000 B) 133,333 C) 82,500 D) 100,500

The downward sloping aggregate demand curve can be explained in part through the:

A. wealth effect. B. negative relationship between the price level and net exports. C. negative relationship between the price level and investment spending. D. All of these are true.

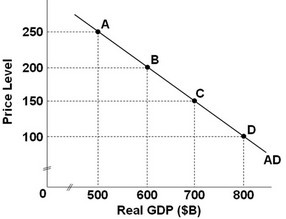

Use the following graph, which shows an aggregate demand curve, to answer the next question, If the price level decreases from 200 to 100, the real output demanded will ________.

If the price level decreases from 200 to 100, the real output demanded will ________.

A. increase by $800 billion B. decrease by $600 billion C. increase by $200 billion D. decrease by $200 billion

When you go to a baseball game your ticket specifies your seat and section of the stadium where the seat is located. Assuming the seats all cost nearly the same to install and maintain, what pricing strategy would you expect the team officials to adopt if a full stadium with a maximum of satisfied customers and at least normal profit is the goal?

A. Price all seats at cost, which includes normal profit. B. Price above cost for seats with the best view and below cost for less desirable seats so the gain from those willing to pay more for the best seats offsets the loss on the cheap seats. C. Price all seats above cost so if there are empty seats, at least total costs can hopefully be covered. D. Price above cost for the seats with the best view and price at cost for the rest even if this means the stadium is not full. At least total cost with normal profit will be achieved.