Which of the following is NOT a condition of a perfect competition:

A. each firm has complete knowledge about production and prices

B. industry sales are small

C. unrestricted entry and exit

D. a single firm cannot affect market supply

E. products produced by rival firms are perfect substitutes

Answer: B

You might also like to view...

Starting from long-run equilibrium, a large tax increase will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. recessionary; lower; potential B. expansionary; lower; potential C. expansionary; higher; potential D. recessionary; lower; lower

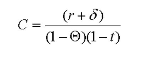

Assume that the user cost of capital (C) is simply

where r is the after tax rate of return, ? is the depreciation rate, ? is the corporate tax rate and,

r is the individual tax rate. Now assume further that the after-tax rate of return is 10 percent

and the economic depreciation rate is 2 percent. The firm faces corporate taxes of 35 percent

with an individual tax rate of 25 percent. Suppose that we now know that the present value of

depreciation allowances is 0.20. In addition, there is an investment tax credit of 0.10. What

effect does this new information have on the user cost of capital?

The market allocates goods to individuals according to the individuals’

A. desire for the good. B. ability to pay for the good. C. desire and ability to pay for the good. D. political influence.

The shape of the firm's marginal revenue curve depends on

A. how high production is. B. how many competitors it has. C. how high its costs are. D. whether the firm is a profit maximizer.