A speculator takes a long position in a futures contract on a commodity on November 1, 2012 to hedge an exposure on March 1, 2013 . The initial futures price is $60 . On December 31, 2012 the futures price is $61 . On March 1, 2013 it is $64

The contract is closed out on March 1, 2013 . What gain is recognized in the accounting year January 1 to December 31, 2013? Each contract is on 1000 units of the commodity.

A. $0

B. $1,000

C. $3,000

D. $4,000

C

In this case there is no hedge accounting. Gains or losses are accounted for as they are accrued. The price per unit increases by $3 in 2013 . The total gain in 2013 is therefore $3,000 .

You might also like to view...

Local marketing reflects a growing trend called grassroots marketing. What are the characteristics of grassroots marketing?

What will be an ideal response?

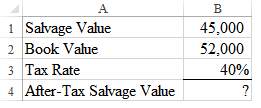

What is the correct formula to calculate the after-tax salvage cash flow in B4?

a) =(B1-B2)*B3

b) =B1-(B1-B2)*B3

c) =B1-B1*B3

d) =B1+(B1-B2)*B3

e) =B1-(B2-B1)*B3

How and why did the AICPA’s role change under Sarbanes-Oxley?

What will be an ideal response?

Compare and contrast joint tenancy and tenancy by the entirety