Diego Company manufactures one product that is sold for $80 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 40,000 units and sold 35,000 units

Diego Company manufactures one product that is sold for $80 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 40,000 units and sold 35,000 units

| Variable costs per unit: | ||

| Manufacturing: | ||

| Direct materials | $ | 24 |

| Direct labor | $ | 14 |

| Variable manufacturing overhead | $ | 2 |

| Variable selling and administrative | $ | 4 |

| Fixed costs per year: | ||

| Fixed manufacturing overhead | $ | 800,000 |

| Fixed selling and administrative expense | $ | 496,000 |

The company sold 25,000 units in the East region and 10,000 units in the West region. It determined that $250,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $96,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product.

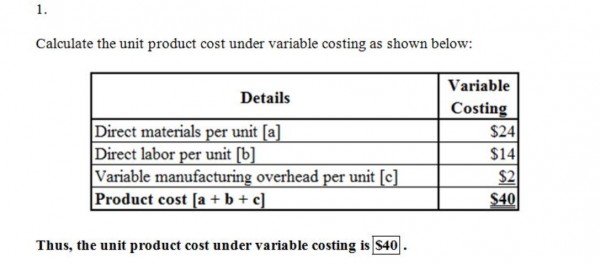

1. What is the unit product cost under variable costing?

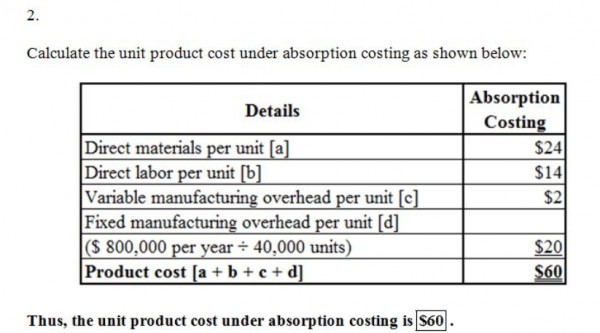

2. What is the unit product cost under absorption costing?

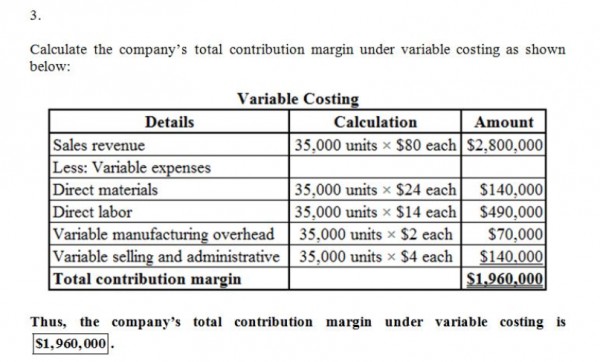

3. What is the company’s total contribution margin under variable costing?

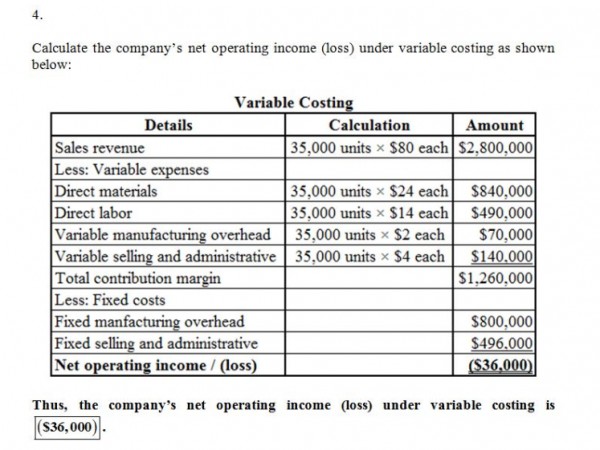

4. What is the company’s net operating income (loss) under variable costing?

5. What is the company’s total gross margin under absorption costing?

6. What is the company’s net operating income (loss) under absorption costing?

7. What is the amount of the difference between the variable costing and absorption costing net operating incomes (losses)?

Ans:

You might also like to view...

A permanent increase in autonomous investment causes

A) a less than proportional increase in real Gross Domestic Product (GDP). B) a more than proportional increase in real Gross Domestic Product (GDP). C) an offsetting change in saving that leaves real Gross Domestic Product (GDP) at the same level. D) a proportional increase in real Gross Domestic Product (GDP).

The takings clause states that the government can seize private property only if ________ is provided

A) comparably-valued property B) just compensation C) fair market value D) the seller's asking price

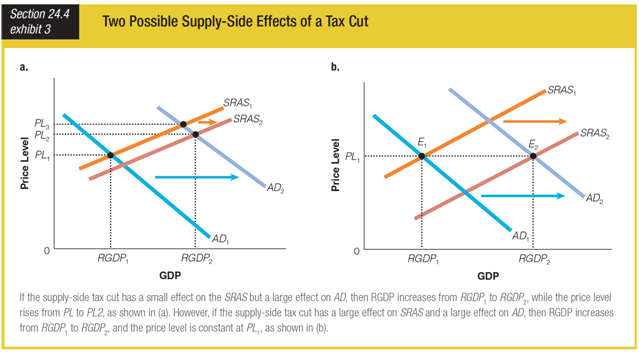

Based on these graphs, if a tax cut has a small effect on the SRAS but a large effect on AD, ______.

a. the price level will increase

b. RGDP will not change

c. RGDP will decrease

d. the price level will decrease

The Great Depression, in which real GDP fell and unemployment rose, can be characterized as a...

What will be an ideal response?