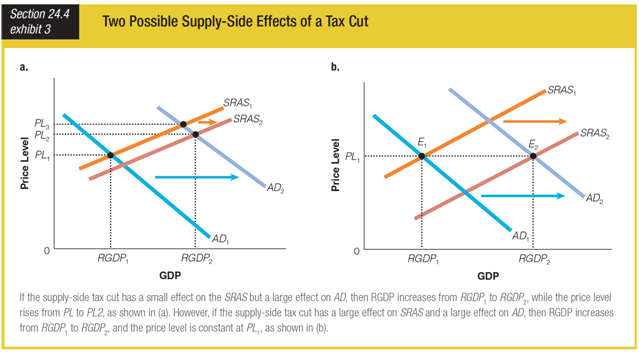

Based on these graphs, if a tax cut has a small effect on the SRAS but a large effect on AD, ______.

a. the price level will increase

b. RGDP will not change

c. RGDP will decrease

d. the price level will decrease

a. the price level will increase

You might also like to view...

Which of the following benefits from a quota or VER?

A) domestic producers B) the government C) consumers D) all of the above

For demand to exist, there must be

a. a desire and an ability to buy. b. a supply of the product in the market. c. a price that is low enough to permit all consumers to afford the product. d. All of these.

To an economist, total costs include

A) explicit, but not implicit costs. B) implicit, but not explicit costs. C) explicit and implicit costs. D) neither explicit nor implicit costs.

A . What effect will a tax on cigarettes have on the consumption of cigarettes and on the wallets of smokers who are addicted to cigarettes? b. What effect will a tax on cigarettes have on the decision of teenagers to smoke? c. Describe the cross elasticity between cigarettes and the price of a Nicoderm patch, which is used to fight the craving for nicotine