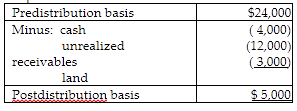

Becky has a $24,000 basis in her partnership interest. She receives a current distribution of $4,000 cash, unrealized receivables with a basis of $12,000 and an FMV of $16,000, and land held as an investment with a basis of $3,000 and an FMV of $8,000. The partners' relative interests in the Sec. 751 assets do not change as a result of the current distribution. The basis of her partnership

interest following the distribution is

A) $5,000.

B) $1,000.

C) $0.

D) ($4,000).

A) $5,000.

You might also like to view...

Which of the following could test the assertion of cutoff for payroll-related liabilities?

A. Compare items in accrued payroll taxes to the supporting payroll tax return. B. Search for unrecorded liabilities. C. Review payroll liabilities for proper classification as short- or long-term. D. Examine payroll tax returns to determine that the expense was recorded in the proper period.

Define stereotyping.

What will be an ideal response?

______ are based on physical evidence, organizational policies and procedures, and personal experience.

A. Repetition B. Direct-factual appeals C. Solution presentations D. Threatening resignation

The Kraft Heinz Company makes MiO Drops. This is an example of a high-tech source of innovation.

Answer the following statement true (T) or false (F)