In the game shown below, firms 1 and 2 must independently decide whether to charge high or low prices.Firm OneFirm Two??High PriceLow Price?High Price(10,10)(5,-5)?Low Price(5,-5)(0,0)Suppose the game is infinitely repeated. Then the "best" the firms could do in a Nash equilibrium is to earn ________ per period.

A. (5, -5)

B. (-5, 5)

C. (10, 10)

D. (0, 0)

Answer: C

You might also like to view...

The U-pick berry market is perfectly competitive. Suppose that all U-pick blueberry farms have the same cost curves and all are making an economic profit. What happens as time passes? What is the long-run equilibrium outcome?

What will be an ideal response?

Refer to Scenario 5.10. Hillary's indifference curves showing her preferences toward risk and return can be shown in a diagram. Expected return is plotted on the vertical axis and standard deviation of return on the horizontal axis

Although her indifference curves are upward sloping and bowed downward, their slope is very gradual (they are almost horizontal). These indifference curves reveal that Hillary is: A) risk neutral. B) risk averse. C) risk loving. D) irrational.

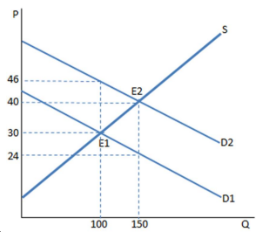

Assume a subsidy to buyers has been enacted in the market in the graph shown. With the subsidy, the producers sell _____ units and receive _____ for each of them.

A. 100; $46

B. 100; $30

C. 150; $40

D. 150; $24

The process by which union and management representatives negotiate a mutually agreeable contract specifying wages, benefits, and working conditions is called

a. collective bargaining b. mediation c. arbitration d. striking e. litigation